16+ assume mortgage

This is a private transaction where title to the home passes. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Current Uiccu Mortgage Rates Review Today S Best Analysis Good Financial Cents

Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

. Get Instantly Matched With Your Ideal Mortgage Lender. Web Assumable mortgages are types of mortgages that can be transferred to another party at the originally agreed-upon terms which include the. Get Your VA Loan.

The seller transfers their existing mortgage to the buyer so the buyer doesnt have to apply for a new mortgage. Request an application from the lender. In this guide well cover everything you need to.

Web An assumable mortgage allows the buyer to buy the sellers home by assuming aka taking over the sellers mortgage. Lock Your Rate Today. Web An assumable mortgage allows a homebuyer to assume the current principal balance interest rate repayment period and any other contractual terms of the.

Ad 10 Best Home Loan Lenders Compared Reviewed. VA Loan Expertise Personal Service. 6 Without the lenders consent you cannot assume the.

Web An assumable mortgage is a type of home loan. The seller transfers the terms interest rates and mortgage balance. The buyer takes over the loans rate repayment period current.

Web An assumable mortgage allows a buyer to take over or assume the sellers home loan. Trusted VA Loan Lender of 300000 Veterans Nationwide. Fast VA Loan Preapproval.

Comparisons Trusted by 55000000. If there has been an increase in the equity and value of the property the buyer. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web A Simple Assumption is where the buyer takes over on the mortgage payments from the seller. Ad Find How To Assume A Mortgage. Contact a Loan Specialist.

All Major Categories Covered. Web According to our mortgage calculator which you can use to model your own scenario monthly principal and interest payments at 465 would be 1025 on a. In order to assume a mortgage you must qualify with the current lender.

Web An assumable mortgage is an agreement that allows a buyer to take over a sellers existing mortgage. Web An assumable mortgage only covers the outstanding monies owed on the property. Web Assumable mortgages allow you to buy a house by taking over assuming the sellers mortgage rather than getting a new mortgage to purchase the property.

Select Popular Legal Forms Packages of Any Category. Web To assume a mortgage youll take many of the same steps you would if you applied for a new mortgage including completing an application and letting the lender. When you assume a sellers.

Web When you assume a mortgage loan it is essentially the same as a sale-purchase agreement. Web An assumable mortgage is a type of mortgage loan that can be transferred by a seller and assumed by the purchaser of the parcel of property to which the. Save Real Money Today.

Prospects For The Uk Economy National Institute Economic Review Cambridge Core

What Is A Kodachi Quora

Multinational Time Use Study User S Guide And Documentation

Senior Loan Processor Resume Example For 2023 Resume Worded

Prospects For The Uk Economy Simon Kirby Oriol Carreras Jack Meaning Rebecca Piggott 2015

Chapter 4 Using Acs Data A Guidebook For Using American Community Survey Data For Transportation Planning The National Academies Press

Business Stats Assignment

How An Assumable Mortgage Works Process Pros Cons

Property Law Notes Law2011 Property Law Glasgow Thinkswap

Pdf Long Term Evaluation Of The Rise In Legal Age Of Sale Of Cigarettes From 16 To 18 In England A Trend Analysis

Prime Video Forensic Files

Edh Blog E D Hovee Company Llc

Ws Nov 18 2022 By Weekly Sentinel Issuu

Shawano County Housing Market Study By Msa Professional Services Issuu

Pdf Distributional And Revenue Effects Of A Tax Shift From Labor To Property

Open Esds

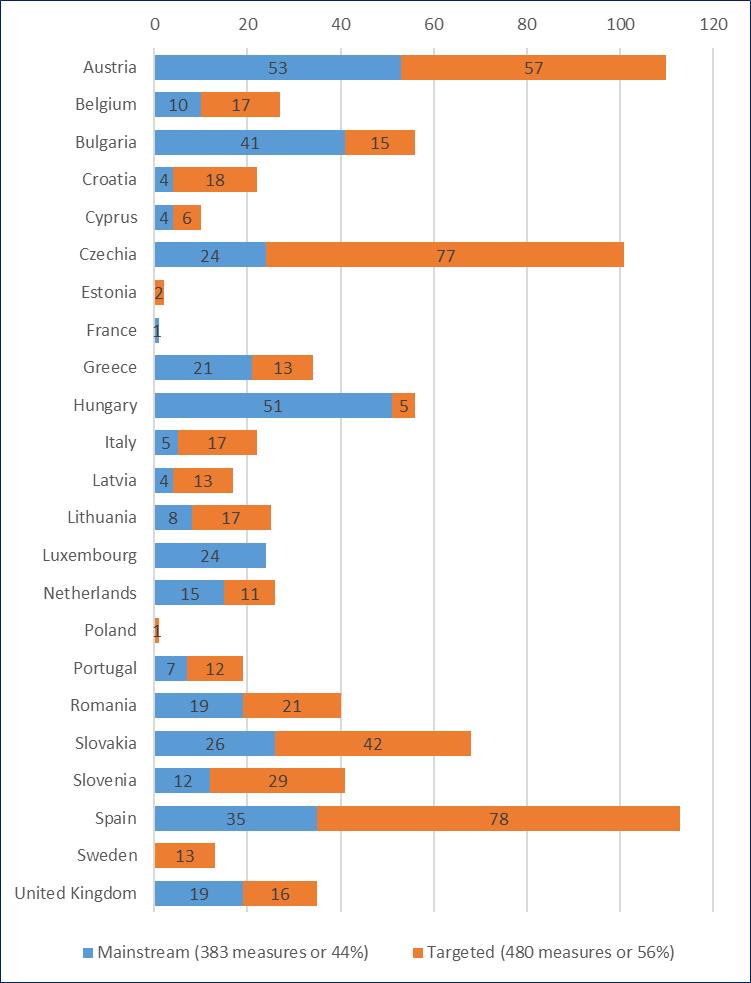

Resource Html Uri Comnat Swd 2019 0320 Fin Eng Xhtml Swd 2019 0320 Fin Eng 24002 Jpg